[Generated Title]: Dodge & Cox International Stock: A Masterclass in Patience and Poise

Okay, folks, let's dive into something truly fascinating: the Dodge & Cox International Stock fund (DODFX). Now, I know what you might be thinking: "Another fund analysis? Yawn." But trust me, this isn't your run-of-the-mill investment breakdown. This is about something much bigger: the power of long-term vision and the art of staying cool when everyone else is panicking. It's a lesson we can all use, whether you're an investor or just trying to navigate the chaos of modern life.

The Art of the Long Game

Morningstar gives Dodge & Cox International Stock a Gold Medalist Rating, and for good reason. Look, the market's a fickle beast, right? It's all too easy to get caught up in the daily noise, the endless barrage of headlines screaming about the next big thing (or the next impending disaster). But Dodge & Cox? They're playing a different game. They're not chasing quick wins; they're building something that lasts.

The fund's management structure is rock solid, which, let's be honest, is a massive relief. We're talking about a committee of six veteran investors who've seen it all. And while there's been some turnover (Mario DiPrisco's departure in late 2024, for example), the firm handled it like pros, seamlessly bringing in Chief Investment Officer David Hoeft. It's like a well-oiled machine, where even if a part needs replacing, the whole thing keeps humming along. This structural integrity, this commitment to continuity, is what gives them the poise to weather any storm.

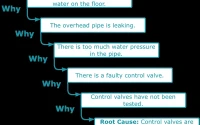

But here's the real magic: their investment ethos. Dodge & Cox has talented in-house analysts doing extensive research to confidently invest in businesses that, frankly, others might find too "sketchy." They find the undervalued gems, the stocks that are cheap for a reason (or, more accurately, a perceived reason). Getting those good deals is central to their approach. It’s like being a savvy antique hunter who can spot a priceless artifact hidden under layers of dust and neglect. They're willing to put in the work, to look beyond the surface, to see the potential that others miss.

And here's where the patience comes in, and it’s absolutely crucial. Dodge & Cox's managers often wait years for their investments to pay off. Years! That requires a level of conviction that's rare in today's hyper-speed world. They're not afraid to get bruised along the way, to endure periods of underperformance. And that's a lesson for us all: true success rarely comes easy or fast. It requires resilience, a willingness to stick to your guns even when things get tough. Fundholders should be ready to endure periods of mediocrity—or worse—before reaping rewards here.

Think of it like planting a tree. You don't expect to see fruit the next day, or even the next year. You nurture it, you protect it, and you wait. And eventually, if you're patient and persistent, you'll be rewarded with a bountiful harvest.

And the proof is in the pudding, right? From Roger Kuo's start in May 2006 through late October 2025, the I share class gained 5.5% annualized, beating most of its peers. The fund climbed nearly 33% for the year through late October, roughly in line with the index and slightly ahead of the typical category peer. Consider Santander (SAN), a Spanish bank with a big presence in Latin America. The fund has owned it since 2010, and for years, it didn't do much. But then, bam! In 2025, the share price doubled. It's a testament to the Dodge & Cox team's fortitude, their willingness to stick with a good investment even when it's not immediately paying off. What Makes Dodge & Cox International Stock an Enticing Fund

This is the kind of breakthrough that reminds me why I got into this field in the first place.

It's Not Just About the Money

What Dodge & Cox is doing is more than just managing a fund; it's demonstrating a way of thinking, a way of approaching the world. It's about resisting the urge to panic, to chase the latest fad, to succumb to short-term pressures. It's about having the courage to stick to your convictions, to invest in what you believe in, and to wait for the fruits of your labor to ripen.

But let's be real: this kind of patience isn't easy. It requires discipline, emotional control, and a healthy dose of humility. It means admitting that you don't have all the answers, that you can't predict the future, and that sometimes, the best thing to do is simply to wait. What does that look like in practice, though? How do you cultivate that kind of long-term vision in a world that's constantly demanding instant gratification?

And, of course, with great power comes great responsibility. What happens when that long-term vision clashes with ethical concerns? What if an investment, while financially sound, contributes to social or environmental harm? These are the questions we need to be asking ourselves, not just as investors, but as citizens of the world.

Ready to Plant Your Own Seeds?

Dodge & Cox International Stock offers a lot, and its fees are fairly modest. Don’t go anywhere. It's a reminder that true wealth isn't just about the numbers in your bank account; it's about the wisdom you accumulate along the way.

Patience: The Ultimate Investment

The numbers don't lie: Dodge & Cox's success isn't just luck. It's a direct result of their patience, their poise, and their unwavering commitment to their investment ethos. They're not just managing money; they're teaching us a masterclass in how to navigate the long game, both in the market and in life.