Title: Fear is a Discount: Why Extreme Market Anxiety is Your Innovation Superfuel

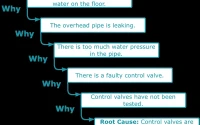

Okay, folks, let’s talk about fear. Specifically, market fear. I know, I know, headlines are screaming about the CNN Money Fear and Greed Index sitting stubbornly in "Extreme Fear" territory – a measly 11.45 as of November 20th, barely budging from the day before. The Crypto Fear and Greed Index? Same story: 11. Extreme fear.

But here’s the thing that isn't being screamed from the rooftops: fear is a gift. A screaming, neon-sign-flashing gift. It’s a flashing buy signal for innovation.

Think about it. When everyone's panicking, pulling back, and hoarding cash, what happens? The playing field clears. The noise dies down. The truly groundbreaking ideas – the ones that can reshape industries – suddenly have room to breathe, to grow, to attract the talent and resources they need. It's like a forest fire clearing away the underbrush, making way for new, stronger growth.

The Calm Before the Breakthrough

We see it across the board, the stock market is showing some resilience, with the Nasdaq, Dow, and S&P 500 all posting gains. Yes, Target had a wobble, but Lowe’s smashed expectations. Exports are up, the trade deficit is shrinking – these are not the signs of a market collapsing, but of one recalibrating, finding its footing before the next leap forward.

And that "leap forward" is crucial. The FOMC minutes hint at internal debate, a sign of active thought and strategy. This isn't stagnation; it's a pressure cooker where new policies and approaches are being forged. It's like the Wright brothers tinkering in their bicycle shop, completely oblivious to the naysayers who said heavier-than-air flight was impossible. They were fueled by something bigger than fear: vision.

The cryptocurrency world, of course, is feeling the chill. "Unease" and "trepidation" are the words being thrown around. But let's be honest: crypto has always been a rollercoaster. Volatility is baked into its DNA. And as any seasoned crypto investor will tell you, periods of intense fear are often the best time to buy. Dollar-cost averaging, diversified holdings, smart stop-loss orders – these aren’t just trading strategies; they're tools for turning fear into opportunity.

Remember the dot-com crash? Everyone thought the internet was a fad. Billions were lost. But from the ashes rose Google, Amazon, and a whole new world of possibilities. This isn’t just history repeating; it’s history rhyming.

What does this mean for us, the innovators, the builders, the dreamers? It means now is the time to double down. To invest in the ideas that scare the status quo. To build the future we want to see, even when everyone else is running for the hills. What could it mean for you? What problem are you uniquely equipped to solve? What future are you uniquely positioned to create?

When I see the Fear and Greed Index flashing red, I don't see a reason to panic. I see a landscape ripe with potential. I see a world hungry for solutions. I see a discount on the future. And honestly, that just makes me want to get to work.

Fear? More Like Fuel.

So, what's the real story? It's simple: Don't let fear paralyze you; let it propel you. The greatest innovations are born in times of uncertainty. This isn’t just a market correction; it’s an innovation catalyst. Now, go build something amazing.